Avocados have become a popular fruit worldwide, with the global avocado market valued at USD 13.97 billion in 2021. The United States, Mexico, and The Netherlands are among the main players in this industry. The US and Mexico have the strongest commercial relations in this market, but the role of The Netherlands is expanding. Holland House Mexico (HHM) conducted a study, commissioned by NLWorks, on the market opportunities of Mexican avocados for the Dutch market.

The expanding role of the Netherlands in the global avocado market led to the question: “Is there a sustainable business opportunity for Mexican producers and exporters of avocados in the Dutch market?” And if so, “How can both economies tap into this potential?”

Experts predict that the avocado market will continue to grow, with a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030. This fruit is expected to remain the fastest-growing commodity of the major tropical fruits for the remainder of this decade. Global production is expected to triple, supported by global demand and lucrative export unit prices.

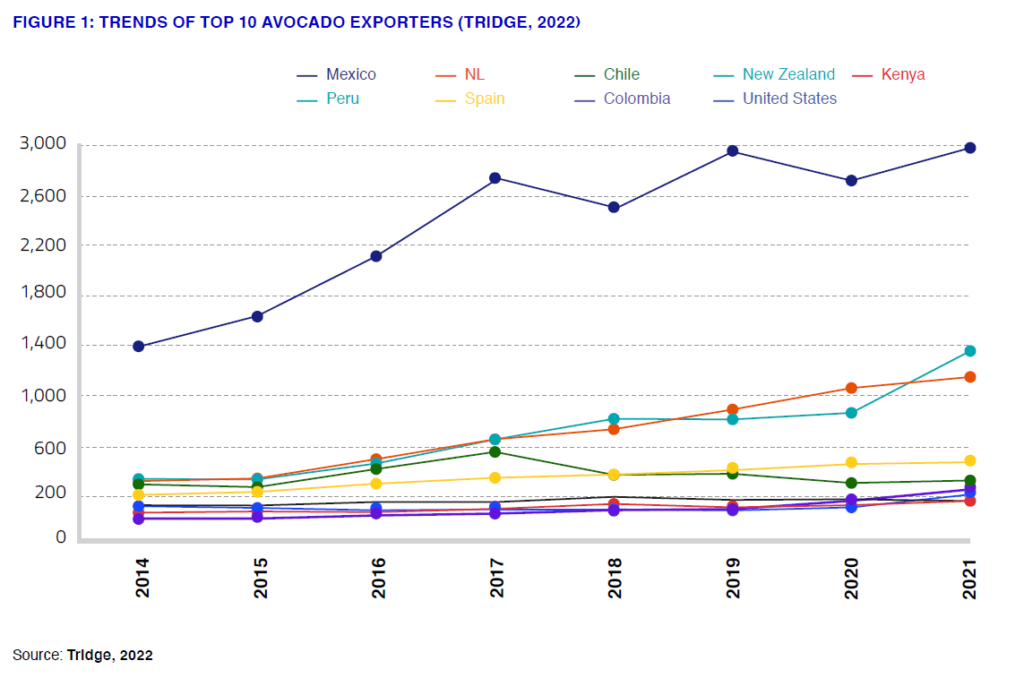

Output in Mexico, the world’s largest producer and exporter, is expected to grow by 5.2% annually over the next 10 years due to continued growth in demand in the US, the key importer of avocados from Mexico. As such, and despite increasing competition from emerging exporters, Mexico is expected to further increase its share of global exports, from 38% in 2022 to 63% by 2030.

Although the US is the largest importer of avocados from Mexico, a growing demand in Europe represents an opportunity for Mexican producers. However, there are a few hurdles that need to be overcome. The main barriers for the Dutch-Mexican avocado trade that can currently be identified include:

- insufficient logistics in terms of sea travel options and global delays

- a lack of properly certified exporters

- and a lack of quality control and quality management between harvest and drop-off at importers´ warehouses.

Other barriers include low prices in the Dutch import market and a lack of promotion in the destination countries. Which can create higher risks for exporters in comparison to exporting to the US.

In the past decade, The Netherlands has positioned itself as the number one non-producing exporter of avocados. After the US, it is the largest importer of avocados, serving as a logistical hub to cater to demands in other parts of Europe, mainly through the Rotterdam seaport. The largest sourcing country is not Mexico, but Peru.

Mexico will need to increase its efforts to remain one of the main sourcing markets for the European avocado trade. The main recommendations to start cashing in on opportunities are:

- to improve logistics by establishing a direct, fast, and cost-efficient sea route;

- to focus on awareness, commitment, and certification among Mexican producers and exporters;

- to improve quality control and management between harvest and reaching the destination in The Netherlands, possibly through a Dutch Quality Control Center;

- and to improve the promotion of Mexican avocados in The Netherlands.

Coordinated collaboration between local and overseas stakeholders and governments is key for successful implementation of these recommendations.

Please find the full report here.

Holland House Mexico is the Dutch-Mexican Chamber of Commerce located in Mexico City, Mexico. They are an independent, privately owned, not-for-profit organization based on memberships. HMM represents the interests of its members in the local market and their respective industries through publications and events, and actively contributes to business development through matchmaking services, commercial missions, and Dutch pavilions at trade exhibitions.